2023 ANNUAL INVESTOR UPDATE

Seabird investors enjoyed exceptional returns across all three of our strategies in 2023:

Muni+: 8.85%

Income+: 14.82%

Equity+: 29.78%

Our long-time clients are aware that our focus is neither on the narrow window of the trailing year, nor the 12 months which lie ahead of us.

Our core focus is fixed squarely on delivering best-in-class investment returns to our investors over long periods of time. Our measuring stick isn’t outperforming our peers per se, but rather on delivering meaningful, real investment returns well in excess of inflation.

***

“The big money is not in the buying and selling, but in the waiting.”

-Charlie Munger

Apart from Warren Buffet, no single person has had as large an influence on us as Charlie Munger. While Charlie’s passing is a great loss to the world, his advice remains timeless. Despite Charlie’s age and his responsibilities as both co-chairman of Berkshire Hathaway and active board member of The Daily Journal, he remained generous with his time and forthright with his personal formulae for success. Ignoring his wisdom and the simplicity of his ideas is, if not a recipe for failure, at least one for mediocrity.

In the brief quote above Charlie manages to capture three of the essential ingredients of building outstanding investment returns; each of which is a core tenet of our own investment process.

First, it is a given truth that no amount of intelligence or labor can produce an investment opportunity where one does not exist. Neither furtive digging nor alchemy can produce gold from thin air. The rational investor understands that capital is deployed most effectively not on his own terms and timing, but only when price and availability dictate.

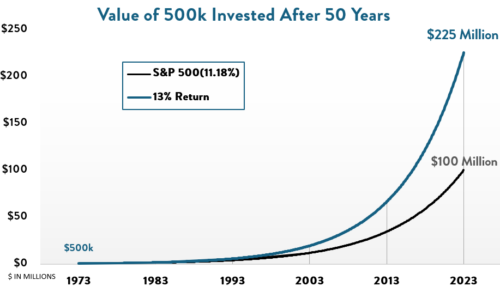

Second, the power of compounding is awesome. As Einstein is credited as saying, “Compound interest is the eighth wonder of the world.”

While it’s easy to visualize investments growing in a straight line, left to compound, the trajectory of investment returns becomes parabolic. (as pictured below)

As remarkable as this chart is, there’s one more ingredient necessary to achieve meteoric results– the observance of Charlie’s first rule of compounding.

“The first rule of compounding is to never disrupt it unnecessarily.”

In short, the investor who has the patience to wait out opportunities to deploy capital over long periods of time, recognizes the ones with the potential to reinvest capital at attractive rates, and has the resolve to stay in the game, is likely to be rewarded handsomely.

***

Across all strategies we employ a value-oriented framework that promotes a culture of patience and resolve. Our framework seeks investment opportunities which provide a “heads I win a lot, tails I win a little less” outcome. This discipline makes it easier for us to recognize when a seemingly brilliant idea also contains the potential to destroy capital. Distinguishing that a potentially unpleasant outcome exists doesn’t mean we’re predicting its occurrence, but rather recognizing its probability and our distaste for experiencing it.

Charlie of course said it best:

“All I want to know is where I’m going to die so I’ll never go there.”

Not only does this mindset promote a culture of prudence when seeking new investments, it requires us to invert and review our convictions, precluding us from making investments that have the potential to cause permanent loss.

This is one reason investors won’t find us making bets on the direction of interest rates. The only thing we can predict confidently about interest rates is that over time, they will change.

***

Finally, a quick comment on inflation. The most predictable and pernicious threat to capital is inflation. We have doubts that the widely distributed statistics on inflation are accurate, and, in any case, the rate of inflation may be different for each of us depending on where we live or what lifestyle we enjoy.

It’s necessary for any investment manager to recognize that its returns must be viewed in real, inflation-adjusted dollars, and that inflation also compounds against us over time. A positive return on paper is a diminution of wealth unless it outruns the rate of inflation. That yardstick will always be more important to us than our performance versus the investment complex, which often operates to feed itself rather than its clientele.

EQUITIES

Our equity portfolios enter the year with plenty of dry powder – close to 20% in cash and another 8% or so in bonds- while we keep our eyes open for opportunities to compound at rates in excess of historic market returns. We’re always on the lookout for CEOs who demonstrate the ability to reallocate corporate profits at double digit returns in businesses which have attractive economics and formidable barriers to competitive entry.

Looking backward, our Equity+ strategy has outperformed both the broad market (as measured by the S&P500 index) and our peers adhering to our discipline of “value” investing.

Our cash position now leaves us in a rather uniquely fortuitous position; able to benefit from either a broad market rally or a broad market decline which allows us to deploy our capital.

FIXED INCOME

Unlike our equity strategy, both of our fixed income strategies enter the year almost fully invested – just the way we like it. Our goal is to keep any capital allocated to fixed income fully invested at all times, if and only if it remains invested at rates in excess of the expected rate of inflation.

In general, fixed income investments have been unable to meet our requirement over the past decade. While many may scratch their heads trying to figure out where we found steady investments which outperformed inflation, we’ve been scratching ours trying to figure out why anyone would knowingly invest capital at rates below the rate of inflation.

But the past is the past. Below is our current positioning which spells out, in simple terms, our expectation for the future.

Muni+ as of 12/31/23:

Cash Yield: 4.6%

Discount to par: 9%

Duration: 5 years

***

Bloomberg AAA 5yr Muni Yield: 2.2%

Income+ as of 12/31/23:

Cash Yield: 5.9%

% Discount to par: 12%

Avg. maturity/float: 2.7 years

***

US Treasury 10 Year Yield: 3.9%

For our clients who seek distributable income the first data point gives you a sense of the likely availability of annual income from your portfolio in percentage terms. The second data point – the discount (or premium) to par – or some portion of it, should be added (or subtracted in the case of a premium) to the first data point to give you a sense of your projected total return. Finally, the duration of your portfolio gives a sense of how long it will take to recoup the discount. To be conservative for example, our framework of thinking about Muni+ is that portfolios will produce distributable yield of 4.6% while recouping some portion of the 9% discount over 5 years. If only one point of discount is recouped each year, the potential total return exceeds 5.5%.

The readily available return from the average mutual fund however, is closer to the 2.2% market average, a number which we believe to be highly unlikely to keep up with inflation.

-Arch Peregoff

-Joe Di Scala